Updated January 10, 2026

SEO for Financial Services: 10 Proven Strategies for 2026

I never expected SEO for financial companies to be so challenging until I spent over 16 months working with a client in the finance industry just to reach consistent, tangible results. The content was strong, the backlinks were high quality, but in finance, even if you do everything “right,” it’s still incredibly hard to convince Google that you deserve to rank, especially when trust, compliance, and authority carry more weight than usual.

In this guide, I’ll break down the top challenges I faced working on a financial SEO campaign, the strategies that finally produced results, and what financial service providers should be doing right now if they’re serious about long-term growth through search. Whether you’re in insurance, investment, lending, or fintech, I tried to find something specific for you. So grab your notepad, this might just be the most useful SEO advice you’ve read for your niche.

If you’re ready to grow with financial SEO services that bring results, let’s talk today.

What is Financial SEO?

In simple words, financial SEO is just SEO, but customized specifically for businesses in the financial industry, including banks, investment firms, accounting companies, fintech platforms, and even financial advisors. The core idea is to help these businesses appear higher on Google (LLMs and other search engines) when people search for financial-related keywords.” However, unlike regular SEO, financial SEO has stricter rules, more competition, and way more trust signals that matter.

You need to earn trust before anyone clicks. People are handing over their money, their data, or both. Google’s smart enough to know this, so it doesn’t just rank pages based on keywords. It looks at your credibility, your expertise, and your overall reputation (which is very hard to earn, honestly).

1. Optimize for High-E-E-A-T

If you’re a regular reader of my blog, you should’ve noticed that it’s not the first time I strongly recommend optimizing your overall website and content for Google’s E-E-A-T, especially if you’re doing SEO for healthcare providers, dental clinics, and sectors that fall in the YMYL category.

In this financial industry, E-E-A-T is under a microscope. Financial queries cause some of the strictest review from Google’s algorithms because even a small mistake in advice can cost users real money.

If you’re familiar with the concept, I’m sure you know the basic tips (I’ve tried some too), but let me share with you some specific practices for financial websites.

First of all, you can include legal disclaimers and compliance notes. It may seem like a boring add-on, but having those disclosures tells Google (and readers) that you operate responsibly. Pages dealing with loans, taxes, or investment advice should always include them.

Next, try to get your company listed on FINRA’s BrokerCheck, BBB, or relevant financial directories. Sometimes it’s not easy, and the process requires a lot of patience, but if you can do that, I’m sure you won’t regret it.

Reference government or .gov financial sources. If you’re quoting a regulation, use the IRS, SEC, or FCA source. Outbound links to high-authority, trustworthy domains help build the context that your content is part of a trusted ecosystem.

If possible, use named authors, not “Team” or “Admin.” Make your financial blog look like it’s coming from professionals, not ghosts. Add a byline, link to their bio, and make that bio a real profile, not just a couple of sentences.

Mention security certifications in the footer or trust badges. Especially if you’re collecting user data. ISO 27001, SOC 2 compliance, or even just “256-bit SSL encryption” shows you take data seriously.

I know nothing is easy, but try to build mentions from financial news and education sites. A HARO quote on Nasdaq, a guest article on Investopedia, or even being listed as a partner on a bank’s site goes a long way.

Finally, update your content frequently. Outdated financial info breaks trust in seconds. Set a quarterly review process, and use timestamps on your content updates.

2. Create Bio Pages for Advisors

In every industry, bio pages help establish credibility, but sometimes general businesses can afford not to add bios and still rank, while for financial companies, it’s a big risk.

Here are a few tips to optimize your authors’ bios:

Start with verifiable credentials. CFP, CFA, CPA, JD, whatever applies, list it prominently. Don’t just abbreviate; explain what each certification means for the reader. Link to professional registries when possible (like FINRA’s BrokerCheck, CFP Board, etc.).

Invest in a clean, trustworthy image that shows your advisor’s professionalism. It humanizes the content and adds visual credibility. Next, list associations and memberships. Whether it’s the AICPA, NAPFA, or a local financial association, these organizations signal involvement in the professional community.

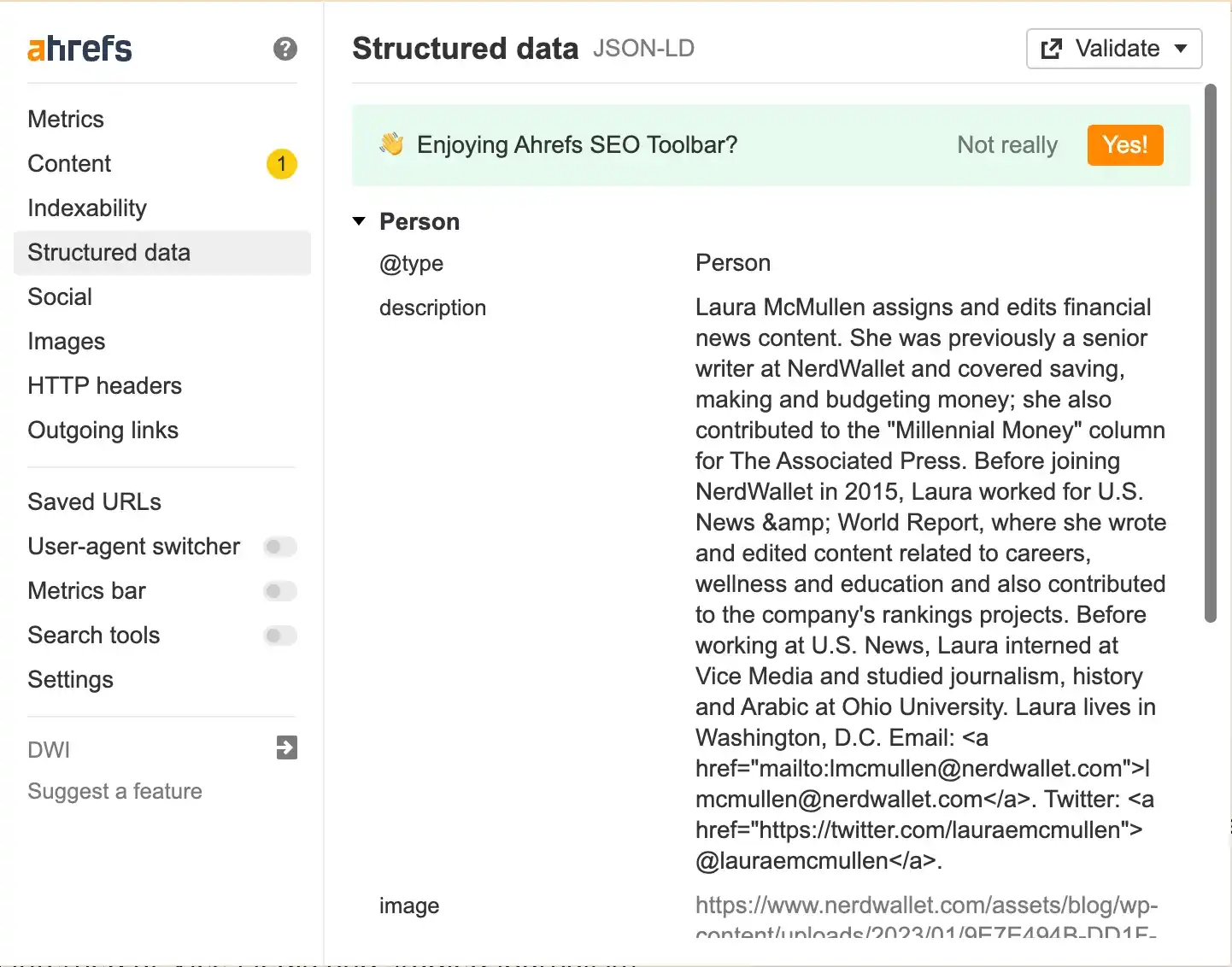

Add author schema and structured data to help Google connect your advisor’s name, credentials, and expertise across your site and even other sites. It’s one of the most overlooked steps.

Try to highlight media features and published work. If the advisor has been quoted in Forbes, NerdWallet, Bloomberg, or even a respected local finance publication, add it. Better yet, include outbound links to those mentions.

Don’t forget off-site reputation. Build your advisors’ profiles on third-party platforms like Investopedia, Crunchbase, or even Wikipedia (if notable enough).

Keep the page updated. When an advisor earns a new certification, speaks at a conference, or gets featured somewhere, update the bio section.

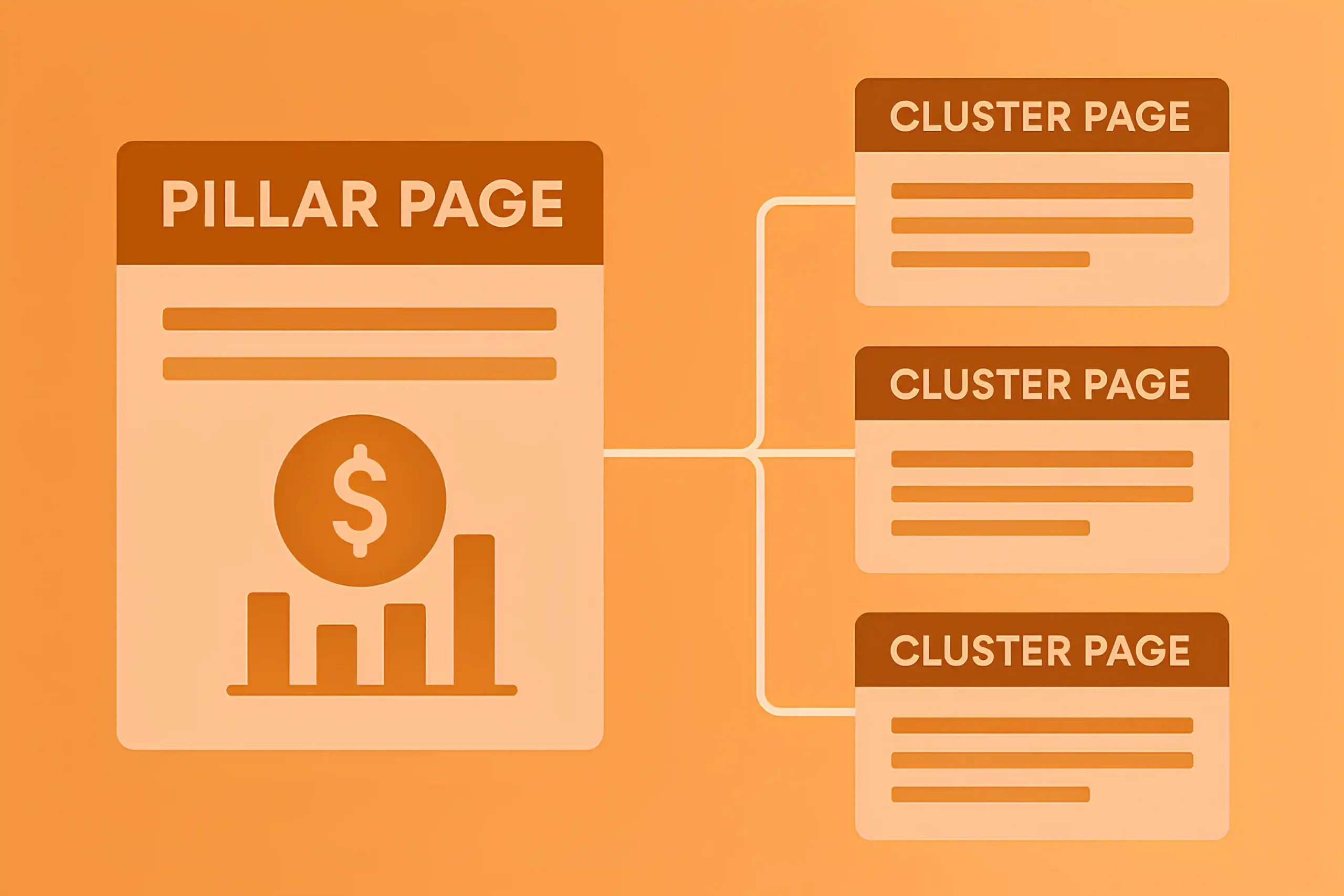

3. Build a Content Hub

A content hub is a great way to organize your website content around one main topic. It starts with a pillar page, a big, detailed guide that covers the topic broadly. Then, it links out to cluster pages; smaller, more focused posts that dive into specific subtopics. All the pages are connected through internal links, so readers (and Google) can easily explore the whole topic.

Let’s say your pillar topic is “Retirement Planning.” You’d create a long, evergreen page that covers everything: 401(k)s, IRAs, pension plans, and withdrawal strategies. Then, you’d create more focused sub-pages like:

- When Should I Convert to a Roth IRA?

- Retirement Strategies for High-Income Earners

- How to Plan Retirement as a Business Owner

The sub-pages dive into specific user concerns and link back to the main page to help Google understand your site’s hierarchy and your expertise in the topic.

If you’re only picking topics with high search volume or “low keyword difficulty,” you’ll miss the many opportunities, the ones buried in forums, client questions, and niche searches.

Focus on what your audience cares about, even if the keyword tools say the volume is “zero.” For example, “Can I contribute to both a SEP IRA and a Roth IRA?” might not show volume in tools, but I’m sure users are Googling it every day (GSC can prove it).

4. Target Service + Industry Queries

One of the best financial SEO strategies we executed in our campaigns was shifting away from generic service pages and instead targeting long-tail combinations like “401(k) management for tech startups” or “tax planning for real estate investors.”

Remember, if you’re a financial advisor or firm, saying “We offer tax planning” isn’t enough. Everyone does. But if you target searches like “tax planning for consultants working overseas” or “retirement advice for software engineers in startups,” you double your chances.

Here’s how we usually approach it:

Start with your strongest industries. Who do you already serve? If 30% of your clients are Amazon sellers or construction companies, that’s where you start.

Next, map your services to industry-specific needs. For example:

“401(k) Planning for Startup Founders”

“Bookkeeping for Dental Practices”

“Succession Planning for Law Firms”

“Tax Optimization for Solo Tech Consultants”

I think it won’t work for industries that are too broad or where compliance restricts personalization, like big banks or insurance companies. But even then, there’s often room in blog content or service pages to include industry-focused angles.

5. Publish Regulatory & Tax Update Content

Google has always shown a preference for fresh, relevant, and time-sensitive information, especially in YMYL niches like finance, where outdated advice can lead to serious consequences for users. So, if you’re a financial firm, tax advisor, or wealth management company, becoming the source of truth during IRS or SEC changes is a golden opportunity.

You can also mark up your dates properly and use FAQ schema to answer common questions users might have about that regulation, making your content more accessible for search engines and large language models (LLMs) like ChatGPT or Perplexity, which often scan for well-structured, up-to-date data.

But again, you need to be selective. Target updates that directly impact your clients or the industries you serve. For example, if you help tech startups, prioritize SEC updates on stock issuance or tax reform affecting R&D credits. If you work with real estate investors, cover new property depreciation rules or changes in 1031 exchange regulations.

The best way to stay ahead is by tracking reliable sources like the IRS newsroom, SEC.gov, or niche newsletters.

6. Optimize for “Near Me” and Location Keywords

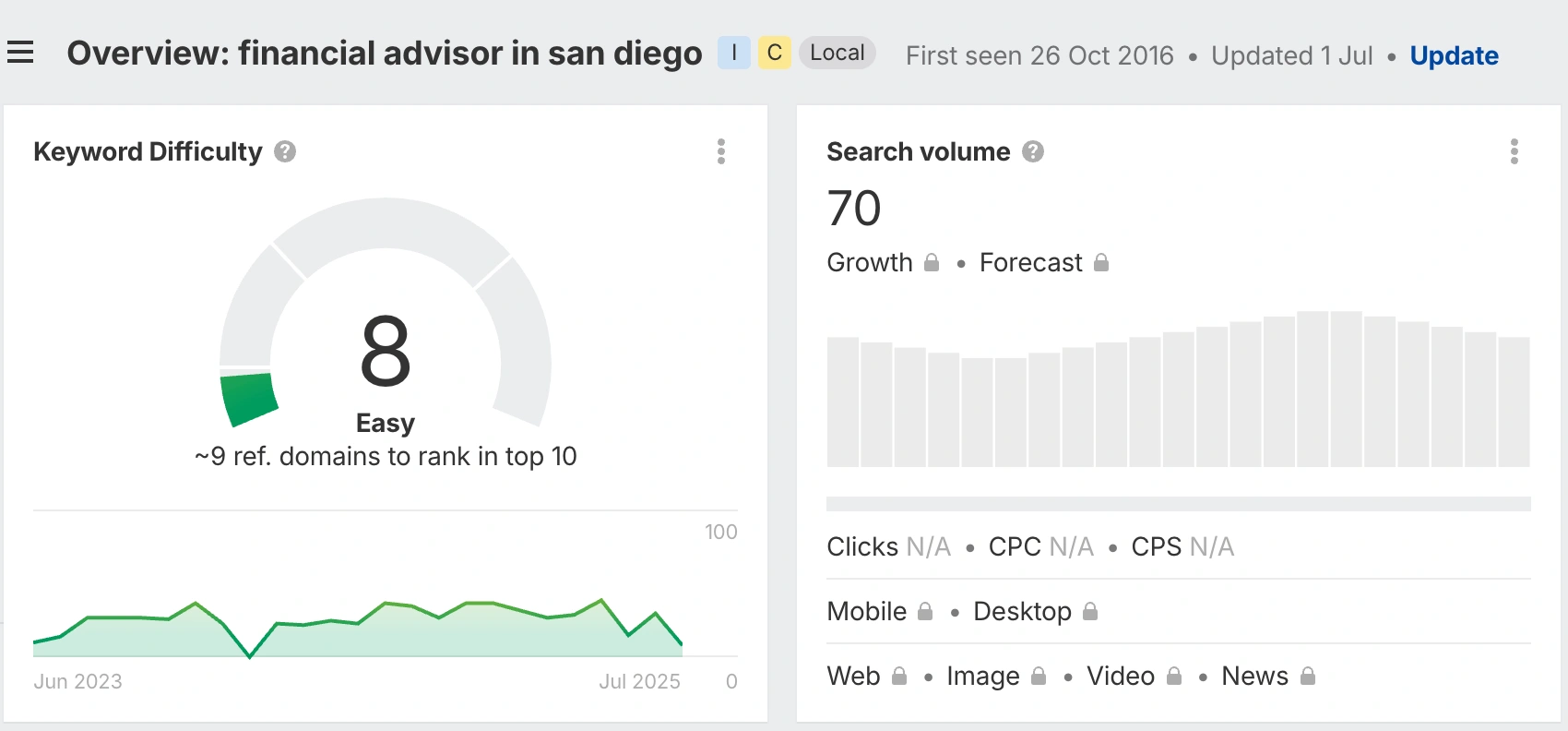

If your financial company operates locally or even if your ideal clients search for services in specific cities, you can’t ignore “near me” and location-based keywords. For example, you can create a customized location page for “financial advisor San Diego,” which has low KD and higher commercial intent than targeting the parent keyword “financial advisor” and competing with industry giants.

For each location page, include testimonials from clients in that area, mention location-specific services (e.g., tax implications unique to San Diego), embed Google Maps, and include links to your physical address if you have one. If you don’t have a branch in that area, tread carefully; focus on places where you offer service coverage or have a virtual presence. Otherwise, Google’s local algorithm won’t reward you.

I know, in such cases, many companies start generating location pages programmatically regardless of their locations, but actually, it’s not a good idea because over time, most of the pages get deindexed.

Instead, run local link-building campaigns and strengthen your two or three location pages with high authority backlinks and brand mentions.

7. Get Quoted in Financial Media & Q&A Content

If you’re running financial SEO campaigns and use the traditional link-building strategies to earn PR mentions and backlinks, the chances you’ll fail are 95%. The same guest posting sites, PBNs, or general link sellers won’t increase your website’s authority; instead, you should think strategically.

If you’re a licensed advisor or someone who knows their stuff, you’re already ahead. You can focus on niche finance blogs like Money Crashers, Modest Money, or Benzinga; they’re much more open to well-written, actionable content from real professionals.

Your chances of getting published on these platforms are fairly good if you can show expertise and write in a way that simplifies complex financial concepts for regular readers.

Another way to get quoted in financial media is HARO. I know, everyone mentions it, but if you’re in finance, this is where it gets interesting. Journalists from places like Business Insider, NerdWallet, and even Forbes are always looking for expert takes on taxes, investing, insurance, retirement planning, you name it.

If you know what you’re talking about and can write a tight, helpful response, they’ll feature you. So, here there are a lot of opportunities to earn links and mentions from high DR websites with high-quality traffic.

8. Use Web-Based Tools That LLMs & Search Engines Can Crawl

When we start working with new clients, our SEO experts always analyze their page and domain-level competitors, and even the ones that fall in the same sector but aren’t direct competitors. Last year, I found that one of our top competitors (also an industry giant) generates over 1 million in organic traffic from calculators alone.

This is crazy, really!

But the fun part is that these tools aren’t hard to build anymore. I’ve used Lovable and similar platforms myself; if you know what you want, you can set one up in a weekend without even writing a line of code.

Free tools have a unique advantage because they solve a problem instantly without asking for anything in return. People search for calculators, estimators, or simple interactive widgets all the time, and when your tool gives them exactly what they need, they stay on your site longer.

Plus, free tools attract backlinks without you having to push for them. Bloggers and journalists love linking to helpful resources, and a well-built tool can easily become the “go-to” link for its topic, which strengthens your domain authority over time.

Of course, you can also turn the traffic into high-margin sales. If someone is already using your tool, they’re showing intent; they’re actively trying to solve a problem your business can handle.

Here, you can add a simple call-to-action after they get their result works well, like offering a free consultation or suggesting they sign up for a quick guide tailored to their calculation (e.g., “Want a step-by-step retirement plan based on these results?”).

9. Use FOIA and Public Data Sets to Create Linkable Financial Content

If you’re in the U.S., you can request government-held financial data, like IRS enforcement stats, SEC complaint filings, or state-level pension fund breakdowns, that no one else is talking about (Not 100% sure if that’s very easy).

Journalists love this stuff. It’s fresh, credible, and often reveals angles that haven’t been covered. You can turn this into blog posts, infographics, or even embeddable charts, and chances are high that financial media, bloggers, and even local newspapers will link to you if you’re the original source or the one who broke it down in a readable way.

If you’re not based in the U.S., many countries have their own version of FOIA or open-data platforms. For example, the UK’s data.gov.uk or the EU Open Data Portal contain goldmines of stats about debt, tax schemes, fraud, public pensions, and more.

Add analysis, trends, and most importantly, headlines that people can’t ignore. For example, “IRS Penalties Doubled in 2025: Who’s Getting Hit and Why” or “The States With the Worst Retirement Planning (and How Yours Compares).”

These types of data-backed content pieces naturally earn links and authority because they combine journalism, original research, and practical value.

Make sure you cite everything properly, include source links, and structure your content in a way that’s easy to consume (using charts, short paragraphs, or embedded Google Sheets if needed).

If you want to learn how to earn high-authority PR backlinks, you can check out my detailed guide on that topic.

10. Run a “Search Intent Gap” Audit by Funnel Stage

This is one of those strategies that separates beginner SEO from real performance-driven content work; running a search intent gap audit by buyer stage. I’m telling you right away, if you don’t have extensive experience in financial SEO or haven’t handled complex financial content workflows before, don’t just Google a checklist and try to follow along.

You need to understand how users search, what they need at different stages, and how your current content performs. Most financial companies are obsessed with ranking for top-of-funnel queries like “What is a Roth IRA?”, which, don’t get me wrong, is fine for traffic. But traffic doesn’t always equal trust, and it rarely equals clients.

Most of them miss mid-funnel and decision-stage queries that often convert better; stuff like “Best Roth IRA accounts for high earners” or “Can I have both a Roth and Traditional IRA?” They show clear consideration intent. So what you need to do is take a closer look at your existing blog posts and pages and ask: where do they fall in the buyer journey? Awareness? Consideration? Decision? Then open your SEO tools or even your own GA4 data, and see where there are gaps.

For financial companies, especially those offering advisory or investment services, this can literally make the difference between 10,000 monthly visitors who bounce and 100 qualified leads who are ready to sign. It’s a slow process, but if you get it right, Google notices (based on my experience).

Financial SEO Tips and Best Practices

Whether you’re running SEO campaigns for banks, fintech startups, or any other financial institution, there’s one thing you need to know: opportunities are endless. After spending months optimizing for some very complex financial sites, I’ve started to notice patterns; what works, what’s a waste of time, and where you should avoid wasting your SEO budget.

In the next section, I’m going to walk you through some of the most practical, sometimes overlooked, and experience-driven financial SEO tips and best practices you’re unlikely to find in a typical SEO checklist.

Disclaimers & Legal Language Are Not Optional

When we kicked off one of our early campaigns for a financial client, we didn’t have the luxury of hiring certified financial advisors to review every piece of content. The client wanted to keep the budget tight for the first few months, so naturally, we focused on producing helpful, straightforward content using simple language.

But as we pushed deeper into the financial SEO sector, it became clear that legal disclaimers and compliance-driven language are non-negotiable. Google’s standards for financial content are extremely high, and failing to include even a basic disclaimer or missing key terminology can raise red flags.

Over time, we began embedding compliance-friendly language, outlining risk factors, and referencing regulatory bodies in our copy. I can not say that was the only reason, but it improved rankings and gave users (and search engines) the trust signals they were looking for.

Data Sources & Citations Play a Big Role

Another important thing we learned quickly while working with financial content is that Google, and now AI models, take citations very seriously. When you’re writing a piece on, say, “Top Tax Planning Strategies for 2026,” it’s not enough to simply sound authoritative.

You need to back it up.

Google prefers verifiable, well-researched content, and LLMs index and reuse content more confidently when it’s supported by inline citations and named references. So, if your goal is to be the go-to resource in finance, treat every stat, claim, or recommendation as something that must be attributed, just like a journalist would.

Include Use Cases, Scenarios, and Examples

Maybe a lot of SEO agencies already know about this, but I couldn’t miss the opportunity to share it with you. We noticed this early on when optimizing blog posts for a financial client; we had pages targeting general queries like “retirement planning for small business owners,” but they only started to get engagement once we added specific scenarios.

For instance: “How a 52-year-old dentist in Chicago saved $18K through a solo 401(k).” Our general advice on contextual storytelling made the difference not just for rankings, but for engagement too.

Search engines, especially Google, look for content that demonstrates expertise in context. Yep, use cases are like proof of that. They also make your content easier for users to absorb. A beginner may not grasp the nuance of tax-loss harvesting, but if you show them a scenario, say, “John, a freelancer who sold his underperforming stocks to offset capital gains”, suddenly it becomes relatable.

From a technical standpoint, use cases can also help you structure content hubs and create internal links.

A pillar page about “Wealth Management Strategies” can link out to real scenarios for small business owners, newly married couples, or high-income earners nearing retirement. It’s a subtle way to show Google that your content covers the full journey, from concept to application.

Want to know which use cases to choose? Start by mapping your services to user personas. Who hires you? What’s their pain point? What decisions are they trying to make? Then, create examples that mirror those problems, and tie them back to your services.

Finance SEO Audit: What You Should Know

If you’re looking for a generic SEO audit checklist, there are thousands out there. But, financial SEO comes with its playbook, and I tried to provide some good advice on where to look and what to audit.

Let’s start with content. In finance, outdated information hurts your rankings and ruins your credibility. That’s why every finance SEO audit should include a full review of time-sensitive elements.

I’m talking about outdated figures (like contribution limits for retirement accounts), old IRS or SEC regulations, outdated fund performance comparisons, and even obsolete product terms. Check every piece of content for up-to-date compliance info, correct financial terminology, and references to the most recent data sets.

Next: audit your backlink profile carefully. Financial sites are frequent targets of negative SEO or low-quality link schemes. Even if it wasn’t your fault, you still have to clean it up. Review your recent backlinks using Ahrefs or Google Search Console, and look for unnatural anchor patterns, irrelevant domains, or massive increases in referring domains that look suspicious.

Finally, audit your internal linking structure to make sure you’re not over-prioritizing low-converting pages or burying high-value service content three levels deep (I know, this is not specific to financial SEO, but again very important).

We do this professionally every day. If you’re curious about how much a proper SEO audit should cost, feel free to check out my full guide on SEO audit pricing. It breaks down everything you need to know before investing.

Local SEO for Financial Services

Not every financial company needs local SEO, but for firms that rely on community trust or offer face-to-face services, it’s a must. For example, local wealth management firms, independent financial advisors, credit unions, small accounting practices, mortgage brokers, insurance advisors, or regional tax planning consultants.

Let’s start with your Google Business Profile. Instead of choosing “Financial Consultant” as the main keyword/service, you can, and absolutely should, add secondary categories like tax preparation services, investment services, insurance broker, or mortgage lender, depending on what you offer.

Next, most companies just list the office address and add a few lines of generic copy. However, for financial services, it’s a great tactic to add compliance-focused FAQs specific to your location.

Also, start collecting local reviews that mention your services by name. Don’t just aim for “Great experience.” Push for ones like “Best 401(k) rollover support in Atlanta” or “Helped me with 2026 small business tax prep in Chicago.”

The results are great, believe me!

Don’t ignore Google Posts or the Q&A section either. You can use them to publish time-sensitive local updates, like changes in property tax laws, deadlines for filing state-specific forms, or seasonal financial planning tips.

SEO for B2B Financial Companies

Look, I’m not claiming I know everything, but after years of working with B2B brands, especially in the financial sector, I saw what works and what doesn’t.

First things first, don’t sleep on analyst-style content. If you have insights from your internal team, CFOs, or industry research, use them. Create “state of the industry” reports, benchmark data, or compliance checklists to build thought leadership. It attracts journalists, B2B buyers, and even earns natural backlinks over time.

Next, if you’re building or marketing a financial SaaS tool, you need to go after queries like “Ramp vs Brex vs [Your Tool]” or “QuickBooks integrations for billing automation tools.” Such pages convert like crazy and let you position your offer directly against competitors in high-stakes search terms.

If your platform connects with tools like NetSuite, Plaid, QuickBooks, or HubSpot, create integration-focused content like: “How to Automate Payouts Using [Your Tool] and QuickBooks” or “Connect [Your Platform] to Plaid for Instant Bank Verification” to attract B2B buyers.

Of course, these are very specific tips tailored for financial companies. But if you’re looking for a broader breakdown that applies to most B2B industries, feel free to check out my full B2B SEO guide; it covers everything from foundational strategies to advanced growth tactics.

SEO for Enterprise Financial Service Providers

I’ve worked with large institutions where the investor relations and press release sections were completely invisible to Google (soon, you will realize why). If you want a competitive edge, optimize your Investor Relations (IR) and Press sections. Convert PDFs into clean, crawlable HTML. Use structured data, link each new quarter’s reports with the previous ones, and add optimized titles that match actual finance-related search terms.

Then there’s one of my favorite angles: owning security-related, enterprise-grade keywords. Your competitors are already bidding on phrases like “SOC 2 compliant financial planning tool” or “bank-grade encryption APIs”; why aren’t you ranking organically for them?

If your product or service meets those standards, match that in your content. Add technical docs, create comparison pages, and publish product FAQs that target how your platform handles encryption, compliance, and enterprise scalability.

If you’re curious how this all ties back to cost, budget, and ROI, feel free to check out my Enterprise SEO Costs guide.

How to Appear in ChatGPT, Perplexity, Etc.

A lot of financial companies now ask me, “How can we appear in ChatGPT answers, DeepSeek, Perplexity summaries, or other AI-powered responses?” It’s a valid question, especially in industries like finance where trust and authority are everything.

First off, LLMs like ChatGPT don’t crawl the web live. What that means is if you want to appear in answers, your content has to be indexed and frequently visited by high-authority third-party sources. They rely on high-quality training data, which includes public websites, licensed content (like Wikipedia, government portals, etc.), and trusted reference pages that get cited a lot. So if your site is a ghost town in terms of backlinks or mentions, you’re already at a disadvantage.

For this reason, I believe PR-style backlinks and mentions on third-party sites are very important. If you’re a financial advisor and you’re publishing content that only lives on your website, you’re talking to a wall. But if you’re cited on Investopedia, featured in a Forbes article, or referenced in a government whitepaper, there’s a much higher chance that your name and insights are part of the data that trained or retrained these models, or are picked up via plugins, browser tools, and citation-based APIs used by tools like Perplexity.

Want to boost your chances even further? Make your content structured and “quotable.” That means using short, clear paragraphs, giving direct answers to common questions, and, this is important, formatting key data or takeaways in a way that’s easily extractable.

So no, there’s no “submit to ChatGPT” button. But if you’re smart about how you publish, where you get mentioned, and how clean and factual your content is, your chances of being part of the answer go way up.

I’ve also put together a detailed guide on AI SEO services. If this topic caught your interest, I’m pretty sure you’ll find that one just as valuable.

The Bottom Line

The truth is, financial SEO isn’t for the faint of heart. It’s slow to show results, heavily reviewed by both Google and users, and packed with more rules than most industries combined. But if you get it right, you’ll own the SERPs, build strong authority, and turn organic traffic into loyal, high-value clients.

From regulatory content and E-E-A-T to hyper-specific long-tail queries and media-worthy insights, we’ve unpacked what works based on hands-on experience. So if you’re serious about scaling your financial brand without tricks or extras, this is your playbook.

If you need an experienced team that gets the challenges of SEO in the financial space, we’re here to help. Explore our financial SEO services, and let’s grow something solid, smart, and safe together.